1. Introduction

In Sri Lanka, the supermarket sector has grown to be a vital part of the retail industry, providing customers convenient and well-organized access to necessities. The Sri Lankan supermarket sector has demonstrated resilience amid economic challenges, contributing over 30% to national GDP and 14% to direct employment [Source: The Sunday Times, 2024].

Over the past 20 years, supermarkets like Cargills Food City, Keells, and Arpico have expanded their reach throughout urban and semi-urban areas. In addition to facilitating effective product distribution, the industry supports local supply chains, generates employment for thousands of people, and promotes economic stability in the country. Supermarkets have shown resilience in the face of economic difficulties, such as import constraints, currency fluctuations, and inflationary pressures, while customer demand for necessities has remained steady. As the Sunday Times (2024) reveals, Cargills Food City demonstrated a 12% year-on-year revenue increase in 2024 reaching Rs. 54,403 million, while John Keells Group’s supermarkets saw same-store sales grow by 12% during the same period, indicating the sector’s capacity to sustain consistent growth in the context of an improving economy.

Adoption of digital technology has emerged as a key trend in Sri Lankan supermarkets. Convenience, time-saving techniques, and technologically enhanced shopping experiences are all having a growing impact on consumer behavior. DataReportal (2024) highlights that in 2025, e-commerce usage in retail is expected to increase from 2% to 4% to 5%, primarily due to urban consumers, who make up a significant proportion of the nation’s internet users. In response, supermarkets have created click-and-collect and home delivery options through collaborations with delivery firms, mobile applications, and online shopping platforms. With the help of these digital initiatives, businesses may reach a wider audience, increase operational effectiveness through real-time inventory management, and boost customer engagement through targeted promotions, loyalty programs, and app notifications.As part of a larger commitment to digital transformation, major companies like Unilever Sri Lanka and Cargills Food City are also incorporating AI-driven solutions to forecast demand and manage supply chains.

The relevance of e-commerce and delivery applications extends beyond basic convenience; they have become an effective tool for maintaining competition in Sri Lanka’s supermarket industry. Particularly in the midst of global upheavals like the COVID-19 epidemic, platforms like Cargills Online, Arpico Online, and Keells Super allow retailers to reach new customer segments, improve service quality, and effectively respond to shifting consumer preferences. Supermarkets in urban and semi-urban areas can ensure a smooth and customized shopping experience for their customers by using these digital channels to optimize operations, manage inventory effectively, track consumer trends, and launch focused marketing initiatives.

This case study aims to investigate how e-commerce and delivery apps are being adopted by Sri Lankan supermarkets, with a particular emphasis on Cargills Food City. It looks at the strategies used, customer reaction, operational results, and implementation difficulties. This case study attempts to help comprehend digital adoption in emerging market retail and offer practical lessons for industry practitioners.

2. Case Backgroud: Cargills Food City.

One of the biggest and most well-known supermarkets in Sri Lanka is Cargills Food City, a subsidiary of Cargills Ceylon PLC. Established in 1844, the business first concentrated on conventional retail trading before progressively growing into contemporary supermarket operations that provide an extensive selection of fresh fruits, groceries, and household goods.

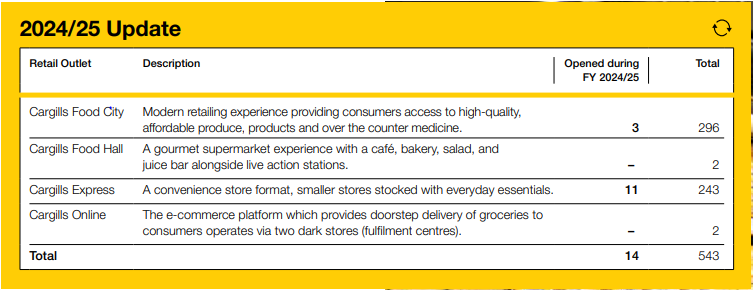

As the Fig. 02 emphasizes; with 296 Cargills Food City’s outlets nationwide, Cargills Ceylon PLC has a significant retail presence (along with the other retail sectors such as Cargills Express, etc) in Sri Lanka’s cities and suburbs, catering to a wide range of customer demographics. It is a household name, known for its high-quality products and customer service, thanks to its wide network and strong brand recognition.

Historically, Cargills relied on traditional supply chain procedures and in-person shopping experiences to run its business mostly through physical stores. Direct product purchases were made by customers in-store, and the business oversaw promotions, logistics, and inventory in each location. The company’s capacity to contact customers outside of the immediate area of its stores was constrained by this conventional strategy, which still helped Cargills create solid relationships with customers, uphold product quality, and foster brand loyalty.

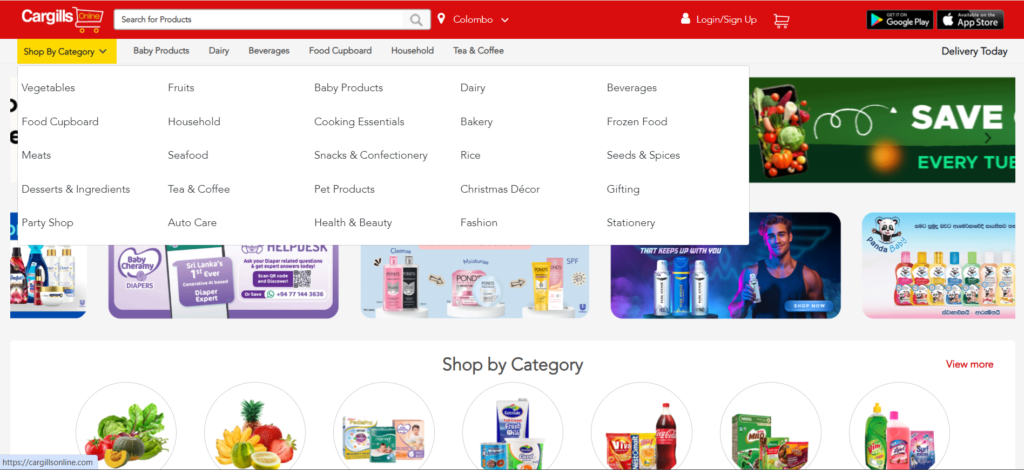

Over the past ten years, Cargills Food City has been undergoing a digital transformation in response to the shifting retail market and the growing desire for online convenience. Customers may now browse products, place purchases, and arrange home delivery through the company’s new online shopping platform, Cargills Online. Along with its extensive product selection; as the Sunday Island Online (2022) revealed, Cargills Online was the first e-commerce platform in Sri Lanka to incorporate LANKAQR, a Central Bank effort that guarantees standardized and interoperable QR-based transactions, giving customers even more ease. By introducing a “dark store” idea that offered fresh produce and a wide variety of products, the platform transformed grocery delivery. Orders could be placed in less than two minutes (currently the company operates with 02 dark stores). Professional agents make on-time deliveries with the assistance of a committed customer experience staff. Cash, cards, online payments, and LANKAQR are all accepted forms of payment, even if “Cash on Delivery” or “Card on Delivery” is chosen. Consumers can pay with LANKAQR at the moment of delivery when they access Cargills Online through the website (https://cargillsonline.com/) or mobile app (Android and iOS).

In December 2024, Cargills expanded its product line beyond groceries by launching its Online Gifting Platform, which allows anybody, anywhere in the world, to send gift cards and hampers to friends and family in Sri Lanka. Beginning with holiday sweets, gift cards, and Christmas hampers, the platform will soon offer year-round gifting alternatives to fit any event. By enabling users to send gift cards or care packs to vulnerable populations including children’s homes, senior care institutions, and natural disaster victims, it also seeks to promote altruistic donating. To ensure convenience and accessibility, gifts can be picked up at more than 100 Cargills store pickup sites or delivered right to the recipients’ doorstep.

This digital adoption has several strategic objectives. In addition to expanding its market reach beyond physical store locations, Cargills hopes to improve operational efficiency by digitally tracking inventory and orders, boost customer engagement through app-based promotions and loyalty programs, and increase convenience for tech-savvy and urban consumers. These initiatives demonstrate the company’s dedication to adjusting to the digital age and maintaining its competitive edge in the rapidly evolving supermarket industry in Sri Lanka.

3. Case Description and Analysis.

3.1 E-commerce Adoption Strategy: Website, App, Delivery Partnerships.

The backbone of Cargills’ digital channel is a full-stack e-grocery platform, which includes a website (cargillsonline.com) and native apps (iOS/Android). These platforms are designed to replicate in-store pricing and assortment while incorporating online-only features like same-day, next-day, and saver slots, doorstep returns and refunds, and scheduled delivery windows. A “dark store” operating model, which consists of specialized micro-fulfillment locations that only pick for online orders, serves as the foundation for the product promise. This approach was created to minimize substitutes and out-of-stocks that hampered food delivery in the early epidemic era. This dark-store strategy is marketed by Cargills as a crucial distinction for precise orders and prompt delivery. Two dark stores located at Colombo District are highlighted as the platform’s operating backbone on the group’s own website, and the platform’s mobile apps have been available since 2020. Beyond in-house logistics, dynamic slotting supports last-mile flexibility instead of relying on a single aggregator. At the same time, the company uses its physical store footprint of 296 food city outlets for inventory pooling and catchment coverage in urban and peri-urban areas. Compared to pure-play e-grocers, Cargills Online has a structural advantage in fulfilment distance (and hence freshness) due to its shop density. With a multi-rail payment approach that includes online cards, cash or card on delivery, and, most importantly, LANKAQR at the door, Cargills is the first e-commerce platform in Sri Lanka to use the country’s QR delivery payment system (which was introduced in 2022).

EconomyNext (2020) reveals that Cargills partnered with UberEats, a third-party delivery company, to expand its delivery zones and manage high order volumes to increase its operational reach specially during Covid-19. Through this collaboration, the company was able to decrease delivery bottlenecks and access the platforms’ current consumer bases. Cargills made an investment in its own fleet of logistics in parallel to maintain control over service quality and guarantee consistency. Furthermore, Cargills broadened its e-commerce approach to cater to the worldwide diaspora community in December 2024 with the introduction of the Online Gifting Platform enabling domestic and overseas purchases of hampers and vouchers with home delivery or pickup at over 100 locations during peak seasons. . With plans to grow into year-round gifting alternatives for birthdays, anniversaries, and religious holidays, this portal initially offered Christmas hampers, gift cards, and seasonal snacks.The gifting site included altruistic alternatives in addition to commercial ones, allowing users to donate gift packs to aged care facilities, children’s homes, or natural disaster victims. Cargills’ capacity to adjust to shifting consumer lifestyles and balance digital innovation with social responsibility was evidenced by this diversification.

Overall, the e-commerce strategy built a complete digital ecosystem that supplemented physical retail by combining niche offerings like gifting, delivery scalability, mobile app ease, and website accessibility. In addition to providing rural people with a digital portal to necessities, this multi-channel strategy was crucial in attracting urban consumers who were looking for ease.

3.2 Consumer Adoption and Experience: Convenience and Satisfaction.

While local friction points (payment trust, item availability, and delivery reliability) are lessened by process decisions, consumer pull factors (time savings, planned basket buildup, and fresh perishable delivery) are in line with the global growth of food e-commerce. Cargills’ own marketing highlights “order weekly groceries in under two minutes,” expert delivery agents, and quick doorstep returns, all of which directly address the most prevalent pain points. Dark-store choosing is intended to reduce “order fill” variance. Through web and app recorded slots and cross-device continuity, the UX (user experience) further lowers the perception of threat.

According to DataReportal (2025), Sri Lanka’s connected consumer base is sufficiently large for a scaled digital grocery. In 2023, there were 14.6 million internet users (approximately 66.7% of the population), and in early 2025, there were approximately 29.3 million mobile connections (approximately 127% of the population), indicating a wide reach for app-driven commerce. Payment readiness has also improved: according to the Central Bank’s Payments Bulletins Q4 of 2024, the number of registered LANKAQR merchants increased from approximately 388k to approximately 421k in 2024 (+8.4% YoY). The volume and value of QR transactions is also continuing to grow, helped by cross-border wallet interoperability (such as Alipay+ and UPI tie-ups), which normalize QR usage for residents as well as tourists. This lowers the friction associated with last-mile payments by enabling customers to place online orders and pay with a QR code upon delivery, even if they originally chose to pay with cash or a card.

Last but not least, the ability to customize convenience is one of the most noteworthy advantages for customers. Cargills Online uses data analytics to customize marketing efforts and provide discounts that are in line with consumer preferences by utilizing a sizable database of past the customer purchases. In a competitive retail market, this not only promotes recurring business but also a feeling of personalized attention, both of which are essential for establishing brand loyalty.

3.3 Operational Outcomes: Sales, Reach, Loyalty and Efficiency.

Three operational metrics show popularity, even though Cargills does not break out e-commerce revenue line-by-line in public reports. First, physical reach: according to Cargills’ 2024/25 annual report, there are contemporary trade stores in every district, which are useful for forward stocking and serving as marketing beacons for digital acquisition. The second is the range of e-commerce categories: the online catalogue offers a complete supermarket assortment (fresh, chilled, frozen, and FMCG) together with regular “Deals of the Month,” which encourage basket building as opposed to one-time top-ups. Third, process and payment efficiency: doorstep LANKAQR streamlines cash processing and expedites reconciliation; dark-store fulfillment offers pick-rate certainty.

With a nationwide e-commerce market increase of 20–25% in 2024 compared to 2023 [ECDB, 2025], Statista Research Department (2025) reveals that the Sri Lankan online grocery segment is expected to reach approximately US$1.02 billion in 2025 (ECDB), demonstrating the significance and expansion of this sector within digital retail. The operational backbone is strengthened by payment data points: With cross-border enablement growing the QR acceptance utility, LankaPay announces significant growth across rails. Additionally, the 4Q-2024 Payments Bulletin reveals that LANKAQR merchants have surpassed 420k and have good quarterly transaction volumes and values. Together, these variables suggest faster cash cycles, higher repeat propensity, and lower last-mile failure rates (fewer unpaid/returned orders), all of which are important components of supermarket unit economics.

Regarding loyalty, Cargills’ omnichannel parity (online store prices) and returns-at-doorstep policy lowers the chance of regret and promotes recurring use. By catering to corporate and festive bulk demand that permeates regular food shopping, the presence of a seasonal giving channel expands lifetime value.

7.4 Challenges Faced: Technological, Logistical and Trust Issues.

Cargills Online has a number of enduring challenges in spite of its notable advancements in digital selling. In terms of technology, the platform needs to be able to handle cold-chain coordination, substitution logic, and real-time inventory—a level of complexity that becomes taxing when demand is strong. Messages like “slots are full” that appear on the Cargills Online app or website indicate that customers may experience capacity limitations during peak times. Pressure to maintain cybersecurity and data protection is increased, particularly in the wake of warnings about breaches in unrelated industries that make consumers more sensitive to digital trust.

Last-mile logistical problems are a major concern. Delivery timelines are disrupted by urban traffic congestion, erratic weather, and sporadic fuel shortages, especially for perishable goods that require immediate handling. Another significant restriction is geographic: Cargills Online only serves customers in Colombo and its surrounding areas at this time, leaving customers in other regions without access. Reddit user “Don’t download this useless app because they support only for Colombo area” encapsulates this displeasure. Broader assessments also draw attention to general limitations: “They only deliver in the Colombo area and suburbs” [AppBrian]. The platform’s potential market reach is weakened by this limited coverage, which also serves to widen the digital divide.

Adoption is rendered more difficult by challenges with trust. Older groups are still reluctant about online shopping because they are concerned about issues like payments, delivery mistakes, product freshness, and restricted return alternatives, whereas younger, tech-savvy consumers tend to embrace it. Despite providing a variety of payment options (cash, card, and LANKAQR), the platform does not completely alleviate concerns. Even though the gifting service was novel, there were initially concerns about quality assurance and prompt delivery to both urban and rural locations.

Cargills has implemented operational and policy improvements to address these problems, including more flexible payment options, responsive customer service, and simplified in-app communication (push notifications and SMS). However, as the company looks to expand digital retail outside of Colombo and scale sustainably in the face of shifting market conditions, striking a balance between technology dependability, logistical coverage, and customer trust is a constant struggle.

4. Discussion

A comprehensive picture of how a traditional retail company in Sri Lanka has undergone digital transformation is provided by the Cargills Food City instance, which has produced both noteworthy achievements and enduring difficulties. One of its biggest achievements is the platform’s innovative LANKAQR integration, which made Cargills the nation’s first e-commerce company to offer standardized, interoperable QR-based doorstep payments. Digital grocery shopping was positioned as modern and reliable because to this innovation, which also directly addressed payment friction. Furthermore, compared to competitors from the early stages of the pandemic, the implementation of a “dark store” fulfillment model—specific micro-fulfillment centers that only handle online orders—proved to be a strategic advantage, significantly lowering substitution errors and improving delivery reliability.Additionally, Cargills was able to manage boosts in order volume without sacrificing service quality due to the logistical elasticity provided by the partnership with UberEats. The Online Gifting Platform, which was later introduced in late 2024, diversified revenue streams and catered to both socially conscious online spending and diaspora demand.

However, the model also highlights its shortcomings. Importantly, a significant section of the population living in rural and secondary cities is not included in Cargills Online’s reach, which is still limited to Colombo and its immediate environment. That disparity erodes competitive resilience and long-term digital engagement potential, particularly in a national setting where other companies might aim for wider geographic coverage. There are still logistical issues; last-mile performance is hampered by urban traffic jams, sporadic fuel shortages, and unfavorable weather, especially for perishables that need strict cold-chain control. Capacity limitations, which are indicated by “slots full” alerts during busy times, imply that infrastructure expenditures have not kept up with customer demand. However, despite flexible payment choices and promotional assurances, persisting trust difficulties continue to limit wider adoption, particularly among older or less tech-literate audiences who remain skeptical of product freshness, order correctness, and return procedures.

Supermarkets and emerging-market traders in Sri Lanka can learn a number of valuable lessons from this scenario. To avoid alienating marginalized populations, digital rollout strategies must first be inclusive and scalable. Careful localized launches reduce operational burden, but they must be complemented by clear expansion roadmaps. Second, in situations where traditional credit infrastructure is inadequate, payment innovation—particularly alignment with nationally backed systems like LANKAQR—can significantly lower adoption hurdles. Third, a gifting and charity channel combined with wholesale retail can increase brand relevance and create new revenue streams. Lastly, operational resilience cannot be compromised; emerging-market retailers need to use flexible energy solutions and hybrid logistics to proactively address infrastructural instability.

From a strategic standpoint, the case emphasizes how important omnichannel integration is. Other chains like Keells or Arpico might follow Cargills’ example of repurposing assets for digital expansion by using its current network of about 296 physical stores for inventory pooling and fulfillment node assistance. Expanding service outside of Colombo is essential, too; setting up micro-fulfillment centers in places like Kandy, Galle, or Jaffna—possibly in association with outside logistics partners—would increase reach while keeping costs under control. Establishing consumer trust will continue to be the cornerstone. Visible data security safeguards, clear replacement and refund procedures, and observable quality controls can soothe older shoppers’ concerns. Confidence can be further strengthened by making investments in cold-chain tracking, real-time inventory systems, and proactive customer service.

Personalization based on data is another important lever. Although Cargills uses promotions based on customer history, more sophisticated predictive analytics and loyalty tools, such geo-targeted offers or personalized recommendations, can increase engagement and reinforce recurring trends. Last but not least, the gifting platform, which is presently seasonally anchored, has the potential to develop into a regular brand extension. It might increase customer lifetime value and establish Cargills as a retail link between the diaspora and home if scaled carefully, adding customary gifts for anniversaries, birthdays, or charitable causes.

In conclusion, the Cargills Food City case illustrates the potential and drawbacks of the development of digital retail in developing nations. Its innovative approaches to gifting, fulfillment, and payments highlight how creativity tailored to regional conditions may produce significant benefits. However, its geographical restrictions, logistical weaknesses, and lack of trust are indicative of persistent difficulties. The key strategic frontier for Sri Lankan supermarkets seeking to create robust, scalable e-commerce ecosystems is striking that balance between creativity and inclusivity, agility and dependability.

5. Conclusion

Cargills Food City’s e-commerce journey demonstrates a methodical and incremental approach to incorporating digital retail into its business processes. To provide online shoppers with an extended grocery experience, the company started by launching its website and mobile application. These platforms provided flexibility that matched changing customer expectations by allowing customers to browse groceries, place online orders, and select between in-store pickup and home delivery. Cargills also partnered with third-party logistics companies and food delivery services like Uber Eats to increase last-mile delivery efficiency. This helped the company reach a wider audience and lessen the strain of running a fully internal delivery system. In addition to digitizing the shopping experience, this strategy aimed to support the company’s overarching objective of offering affordability, accessibility, and convenience to an increasing number of tech-savvy Sri Lankan consumers.

Customers found that using Cargills’ e-commerce services was quite convenient, especially in cities like Colombo where the COVID-19 pandemic’s effects, busy lives, and traffic jams increased demand for online grocery shopping. Consumers benefited from the extensive product variety that reflected in-store availability, time-saving options, and the freedom to avoid crowded supermarkets. Adoption was not without its difficulties, though. The learning curve of switching from traditional operations to totally digital systems was reflected in some customers’ complaints about delivery delays during periods of high demand, sporadic supply shortages, and application usability problems.Notwithstanding these challenges, customer satisfaction was typically good, and many people expressed gratitude for Cargills’ dependable product quality and reputable brand, which gave them more confidence to use its online services.

The results of this digital transformation were complex from an operational standpoint. Online sales helped to significantly boost overall revenue streams, particularly during the pandemic when digital ordering became increasingly necessary. By increasing its online offerings, Cargills was able to reach a wider audience of younger, urban, tech-savvy, and convenience-loving customers. Additionally, loyalty programs and digital promotions integrated within the app strengthened consumer engagement, while operational efficiency improved through better demand forecasting, inventory management, and integration of analytics to track consumer activity. Long-term customer loyalty was further increased by the digital platform’s support of brand positioning by indicating innovation and response to shifting consumer expectations.

However, there were significant obstacles to Cargills’ shift to online retail. To guarantee seamless transactions and safeguard customer data, the business had to make significant technological investments in app development, cybersecurity, and IT infrastructure. The delivery technique was especially complicated logistically. Although third-party collaborations lessened the load, making sure supplies were made on schedule continued to be a problem, especially during times of high demand. Furthermore, concerns about product quality and service dependability made some customers initially reluctant to move from traditional in-store shopping to online transactions, which led to the emergence of trust issues. These difficulties were made harder by Cargills Online’s restricted geographic reach, as it presently mainly serves Colombo and its surrounding areas. In addition to highlighting infrastructure and resource constraints in extending its digital operations, this limited expansion prohibited the company from fully capitalizing on statewide demand. The challenges of expanding the service outside of urban markets were further compounded by logistical obstacles like poor cold chain facilities and low levels of digital literacy in rural locations.

In a major move to broaden its e-commerce offerings, Cargills introduced its Online Gifting Platform in December 2024, further expanding its digital ecosystem. Starting with Christmas hampers and seasonal delights, this portal allowed users, including those who live overseas, to send gift cards and hampers to loved ones in Sri Lanka. In addition to improving customer convenience, this program reaffirmed the business’s commitment to promoting social responsibility and community ties. Gifts could be delivered directly or picked up at more than 100 Cargills locations, enhancing the service’s accessibility and convenience. Cargills demonstrated its dedication to fusing traditional values with contemporary retail solutions by launching this new stream, which will appeal to both socially conscious and family-oriented customers.

In summary, Cargills Food City’s embrace of e-commerce is a result of a combination of operational flexibility and strategic vision. Although the journey has produced favorable results in terms of increased sales, customer satisfaction, and loyalty, it has also revealed important challenges pertaining to logistics, technology advancement, and limited geographic coverage. The company’s innovative endeavors, demonstrated by its collaborations, loyalty programs, and the introduction of the giving platform, underscore its dedication to staying relevant in a market that continues to grow progressively digital. However, tackling scaling difficulties and growing beyond Colombo will be vital for Cargills if it hopes to sustain long-term competitiveness and serve the larger Sri Lankan populace in the digital era.

💡 If you enjoyed this post, let’s stay connected!

🔗 Connect with us on Linkedin.

📸 Follow us on Instagram

We’d love to hear your thoughts, feedback, or experiences in the comments. Let’s keep the conversation going!